The pandemic proved that disruption and chaos can benefit container shipping lines, tariffs are beneficial for some too, with the surge in demand for South American soya beans a direct impact of Donald Trump’s trade policy.

Bimco, this week analysed the trade deal agreed between China and the US as beneficial to both countries, and to the dry bulk market.

“The country [China] has agreed to purchase 12 million tonnes during the rest of 2025 and 25 million tonnes per year during the next three years, similar to 2024 volumes. If these commitments are met, US soya bean shipments are expected to surge in the short term before stabilising in the medium term,” said Bimco’s shipping analysis manager Filipe Gouveia.

In this scenario Bimco believes that South American soya producers will be the losers overall.

Tariff driven impacts on soya shipments are indicative of the distorting effects of import duties across many supply chains, industries and commodities, and raises the expectation that after a year more disruption will follow.

Tariffs are still high

Emily Stausbøll, senior shipping analyst at Xeneta, argues that while the pause in the trade conflict is welcome it will not “breathe life” into softening Pacific demand.

“Tariffs are still high despite the truce and US shippers will use the first half of 2026 to draw down inventories built up through frontloading imports earlier in the year to protect supply chains in the wake of the escalating trade war.”

In fact, Xeneta expects global spot rates to plunge 25% during 2026, with contract rates declining by 10% over the year, and 20% lower than the pre-Red Sea diversions that began in December 2023.

Moreover, with the lack of detail in what is a pause in the conflict, albeit with a definite end point after a year, Stausbøll points out that the lead time for shifting production from one country to another will be longer than the 12 months afforded by the truce.

“No one can say with any degree of certainty what the situation will be when the truce expires – or even if the agreement lasts the full 12 months,” pointed out Stausbøll.

Rare earths and shifting sands

While shipping has focused on the element of the China/US deal that would lower trade barriers, port fees and tariffs, with little attention paid to the enabler of trade in the deal, namely the agreement to maintain exports of rare Earth minerals and metals to the US.

James K. Galbraith, professor at the LBJ School of Public Affairs at The University of Texas, o-author (with Jing Chen), of Entropy Economics: The Living Basis of Value and Production and The Power to Destroy: How Obsolete Economics Drove American Decline to be published next year, argues that the hostile briefing by successive US governments is about to come an end.

“The sands are shifting,” writes Galbraith in the American journal Project Syndicate, “RAND, an eminent redoubt of American national-security thought, has published a landmark paper calling for coexistence with China, and for accepting the CPC [Communist Party of China]’s legitimacy.”

That apparent shift more than seven decades after the Mao’s victory in China’s civil war inspired Galbraith to ask, “what lies behind this apparent thaw?”

The answer, says Galbraith is rare Earth minerals and gallium in particular. A by-product of aluminium and zinc, gallium is critical to the production of electronics. China controls 98% of the global supply of gallium. And there are no substitutes for gallium, or a number of other minerals that China now has effective control over.

By banning the export of these minerals to the US, “China effectively lowered the boom on the prospect of US military confrontation with China.”

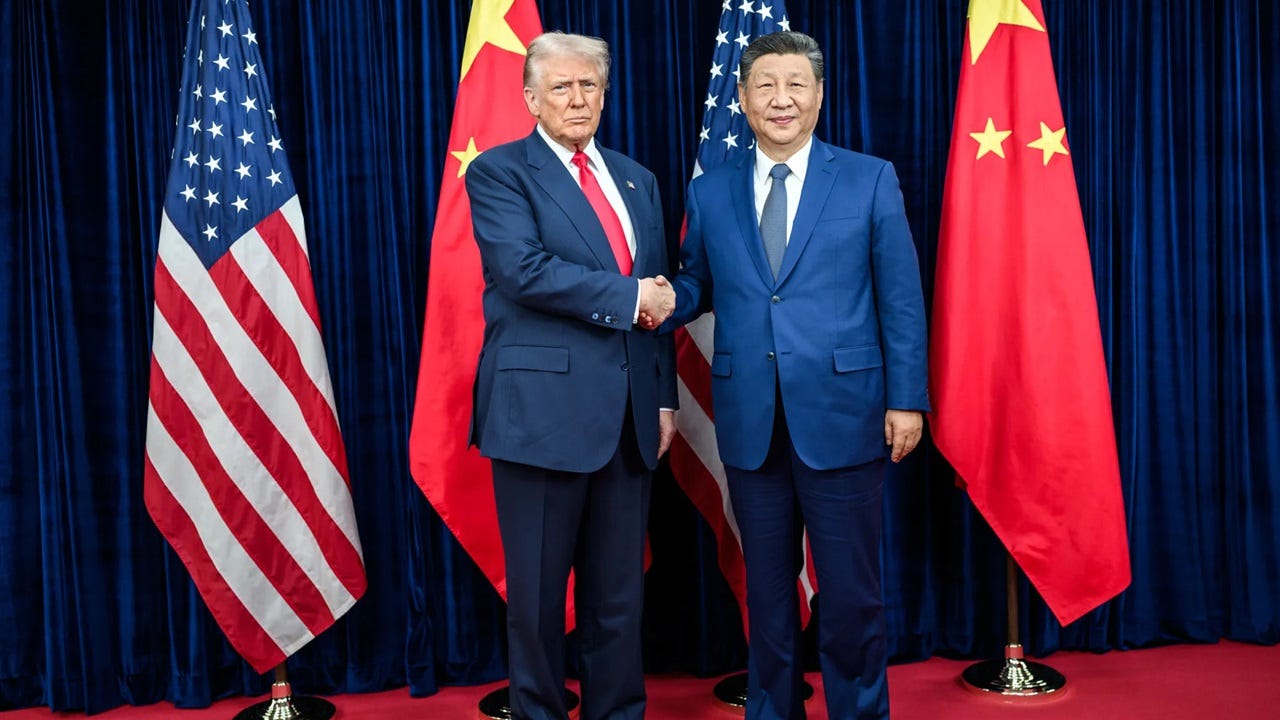

It may also explain Washington’s readiness to come to an accommodation with Beijing. Meanwhile, ahead of Donald Trump’s meeting with Xi Jinping last week, the US rushed to close a number of rare Earth mineral deals, over a 10-day period with Australia, Malaysia, Cambodia, Thailand and Japan.

Reducing reliance on Chinese production

“What we are trying to do now is to get off the Chinese as the primary supply chain, but that will take time,” Dennis Wilder, a former senior US intelligence official and now a senior fellow at Georgetown University, told CNBC.

Reliance on Chinese production, however, is likely to continue for some time into the future. According to research by Goldman Sachs Investment Research with the International Energy Agency reveals that not only does China control the reserves of these minerals, producing 49% of world’s total production. All other producers, including Australia, the US and Myanmar’s production is responsible for the remainder.

China, however, also controls 69% of all rare Earth mineral mining and 92% of the world's refining capacity, and 98% of magnet production, needed for electric car production.

According to Goldman Sachs it can take up to 10 years to develop a mine and building the required refineries is a five-year project for each unit.

Wendy Cutler, senior vice president at Asia Society Policy Institute believes: “Beijing’s latest threat on sweeping extraterritorial export restrictions in this sector has served as a needed wake-up call to partners around the world.”

That is not how Galbraith sees it: “The postponement is, in effect, probation: China will assess, for a year, whether a new spirit of non-aggression, cooperation, de-escalatory rhetoric, and open trade can take hold. If not, the situation will not be better for the US a year from now, and both sides know it.”

In effect that could presage a period of relative stability for container shipping and logistics, stability that many in the industry have said they crave.