The LNG-powered containership, the CMA CGM, on the river Elbe near the city of Hamburg, Germany, February 14, 2021. Photo: FrankHH / Shutterstock.com

LNG-powered vessels have taken center stage in 2024, overshadowing methanol as the preferred alternative fuel choice for green shipping.

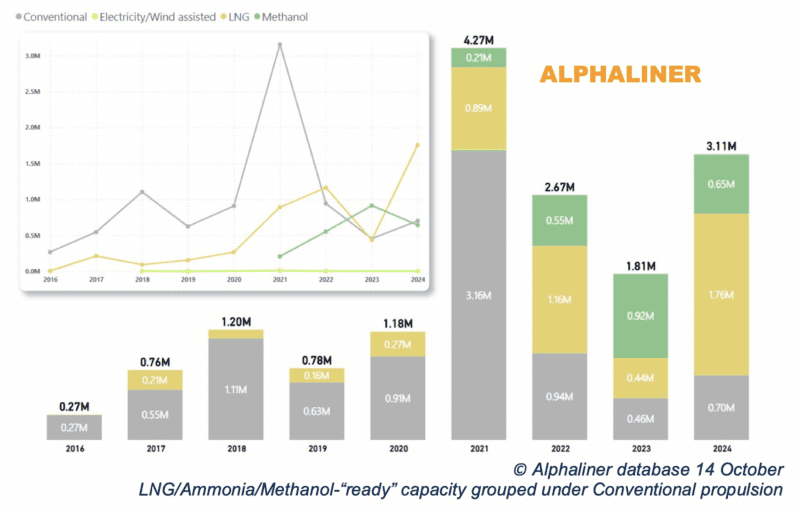

This trend, reported by liner specialist Alphaliner, marks a significant shift in the maritime industry and a notable reversal from the methanol-fueled orders that dominated 2023.

The decline in methanol-powered containership orders is striking. Alphaliner reports that these orders now represent only 21% of new capacity ordered in 2024, down from 51% in 2023. This downturn is primarily due to concerns over the future availability of green methanol, higher-than-expected processing costs, and delays in planned production. An industry study further highlights this issue, revealing that over two-thirds of planned methanol production facilities are yet to receive final budget approval.

In response to these challenges, shipping companies have pivoted back to LNG propulsion to fuel their fleets. The industry has seen a record-breaking 1.76 Mteu of LNG-powered capacity ordered this year, accounting for 55% of the year’s total capacity orders – quadrupling the 440,000 teu contracted in 2023.

Major players like Maersk exemplify this shift. In August, the Danish shipping giant announced plans to split its latest series of up to 60 newbuildings between LNG and methanol propulsion, a notable change from their 2021 commitment to only order vessels operating on green fuels. Maersk is now securing offtake agreements for liquefied bio-methane (bio-LNG) to ensure its new dual-fuel gas vessels reduce greenhouse gas emissions this decade.

DNV’s classification data echoes this trend across shipping sectors. Their AFI platform reported 17 new alternative-fueled vessel orders in September 2024, with LNG outpacing methanol. July and August set records for alternative fuel vessel orders, with LNG leading the way. Jason Stefanatos, Global Decarbonization Director at DNV Maritime, noted, “LNG is clearly the headline story since the summer, accounting for around 60% of all alternative fuelled new orders in the third quarter mainly thanks to a strong uptake in the container segment.”

Size Matters

This trend is particularly pronounced in the larger container vessel segment. Alphaliner reports no orders for methanol propulsion for ships over 14,000 teu this year, with larger ships overwhelmingly opting for LNG propulsion. This shift is expected to continue, with conventionally fuelled tonnage likely to disappear in the +15,000 teu class as delivery dates approach 2029-30.

The growth in LNG-fueled vessels has been remarkable. According to industry coalition SEA-LNG, LNG-powered vessels now comprise over 2% of the global shipping fleet, a figure set to increase to 4% by vessel numbers or 6% by deadweight tonnage (DWT) when considering current orderbooks. The number of LNG-powered vessels has risen from just 21 ships in 2010 to 590 in operation globally today, with an additional 564 vessels on order.

“LNG is the only practical and realistic alternative fuel pathway available today – even for those shipowners that may also be considering other such pathways,” said Peter Keller, Chairman of SEA-LNG. He adds that the LNG pathway, including the use of liquefied biomethane and eventually hydrogen-based e-methane, “currently provides the only viable option to making progress towards 2050, starting with immediate carbon reductions, now.”

As the maritime industry navigates the complex waters of decarbonization, LNG has re-established itself as the principal short-to-medium term choice for carriers. However, the industry’s journey towards sustainability remains dynamic, with ongoing developments in green fuel technologies and production capabilities likely to shape future decisions in this critical sector.