U.S. President Donald Trump and Indian Prime Minister Narendra Modi shake hands as they attend a joint press conference at the White House in Washington, D.C., U.S., February 13, 2025. REUTERS/Kevin Lamarque//File Photo

HONG KONG, July 31 (Reuters Breakingviews) - Donald Trump's shake-up of the world's China-plus-one trade is not creating any decisive winners or losers. The U.S. president's decision on Wednesday to impose a 25% tariff on imports from India is a blow to the South Asian country, but the rate, if it sticks, could still allow it to remain a desirable manufacturing destination for global companies like Apple.

Unlike other world leaders, Narendra Modi did not secure a reduction on Trump's threatened tariff rate for his country, which sent $87 billion of goods to the U.S. last year. The prime minister's apparent refusal to open up India's agriculture and dairy markets to U.S. imports may be why. Doing so would have risked another showdown with millions of poor and politically powerful farmers.

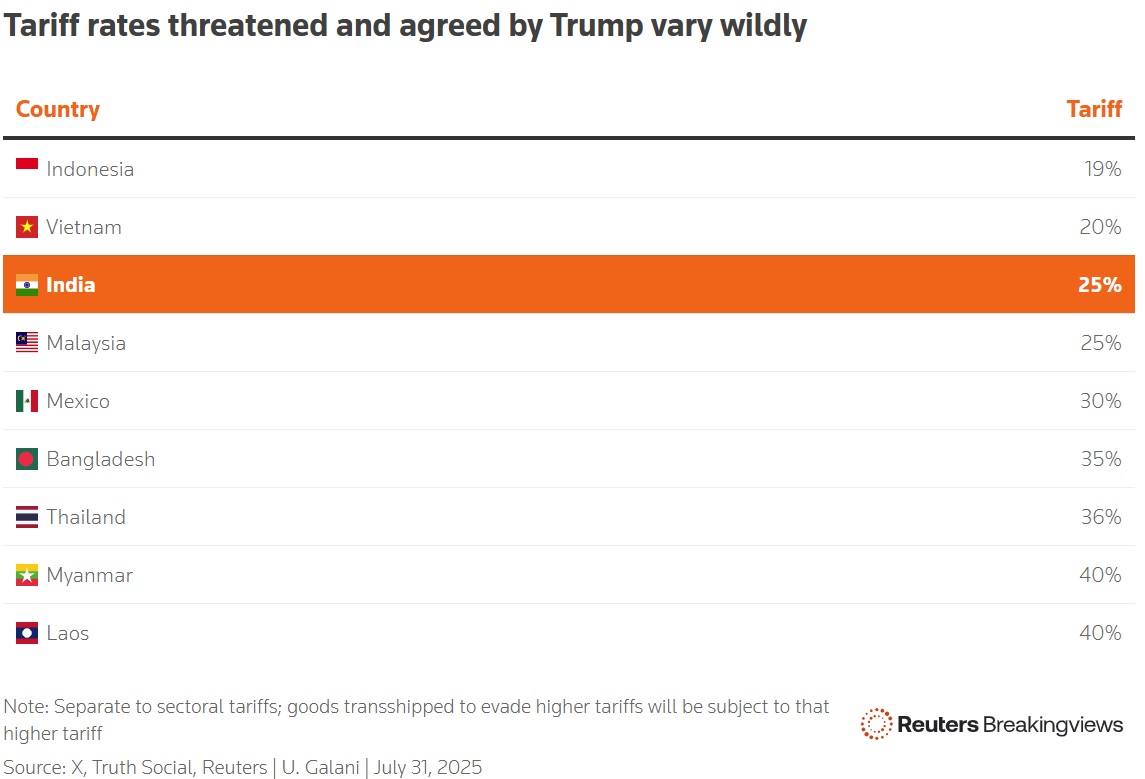

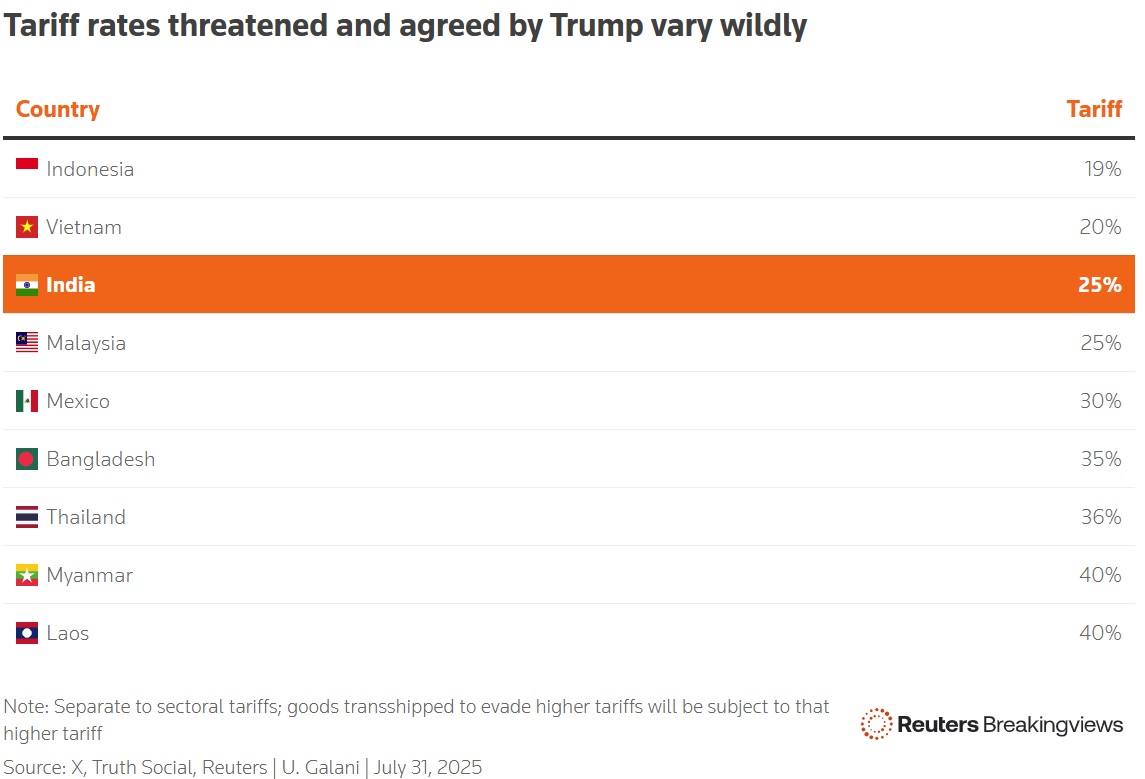

Whether India wins or loses, though, will depend on other factors. The $4 trillion economy has sought to court companies that want to diversify their supply chains away from the People's Republic. Here India's rivals include Bangladesh, Vietnam and the rest of Southeast Asia, and to some extent, Mexico. These competitors currently face U.S. import tariffs ranging from 19% to 40%.

On the face of it, India will now be less competitive as a manufacturing destination than Vietnam, which Trump slapped with a 20% tariff. India's weighted average tariff rate would be five to 10 percentage points higher than Asian peers, Citi economists estimate.

Its status as a top buyer of Russian energy and weapons is also a negative, with Trump now threatening an unspecified penalty for participating in such trade. Russia accounts for up to 40% of India's crude oil imports and offers it an implied discount of up to $4 per barrel. Giving up that benefit would be economically and politically disadvantageous for India.

But Southeast Asia's deep links to Chinese exporters and investment mean the bloc faces stiff penalty tariffs, too, if the U.S. president follows through on his threat to crack down on tariff evasion, or transshipment, by Chinese exporters.

In this scenario, Trump would double the levy for goods they send through Vietnam, for example. This risk will only increase with any deterioration of the Sino-American relationship. Some companies may ignore the tariff differential and stick with India because it offers access to a large domestic consumer market, and it is less exposed to China.

Whether Trump cares more about brokering peace in Ukraine or containing the world's second-largest economy is anyone's guess. The upshot is that he has negotiated or unilaterally declared trade pacts that set diverging tariffs on all the major China-plus-one countries. Ideally, that ought to have provided some clarity for companies currently stuck in limbo to resume capital expenditure. But the U.S. president's outstanding promises to penalise transshipment and those who deal with Russia will leave global companies in no better position to decide how, if at all, to reconfigure their supply chains.