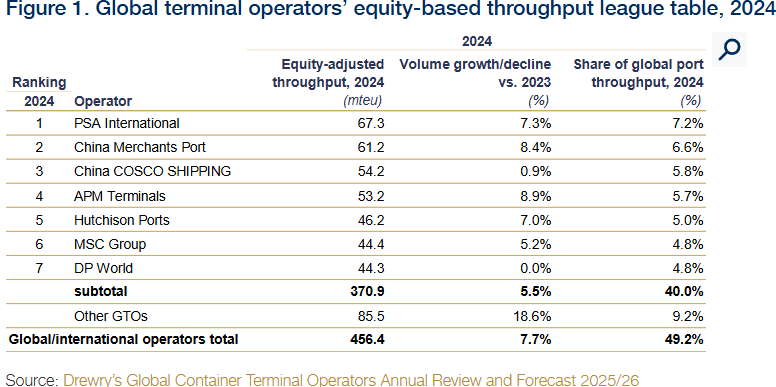

The global container terminal sector demonstrated remarkable resilience in 2024, with Global Terminal Operators (GTOs) achieving a modest but significant increase in market share from 48.9% to 49.2%, as Drewry reported.

This expansion occurred against a backdrop of robust port throughput recovery (+7.2% YoY to 928 million TEUs) and unprecedented operational challenges from geopolitical conflicts and climate disruptions.

The analysis reveals three critical trends reshaping the industry: the accelerated rise of carrier-owned hybrid terminal operators, strategic consolidation through M&A activities, and substantial capacity expansion driven by post-pandemic recovery dynamics.

The modest but strategically significant increase in GTO market share from 48.9% to 49.2% in 2024 represents a fundamental shift in how the container terminal industry operates.

This seemingly small percentage change masks profound structural transformations that are reshaping competitive dynamics across the global maritime sector.

The primary driver behind the GTOs’ market share expansion lies in the strategic advantages gained by carrier-owned hybrid terminal operators.

Companies like MSC Group (through TiL and AGL), CMA CGM (via CMA Terminals and Terminal Link), and Hapag-Lloyd (through Hanseatic Global Terminals) have fundamentally altered competitive dynamics by combining carrier operations with terminal ownership.

This vertical integration creates what industry analysts term “matched ownership” advantages, where terminal operators can guarantee cargo volumes through their shipping lines while maintaining commercial competitiveness with independent operators.

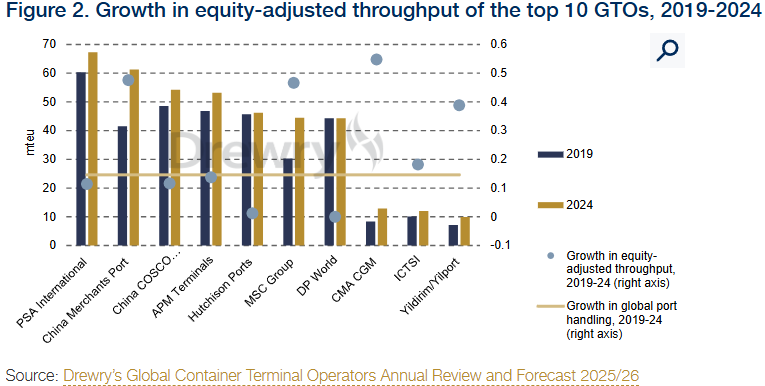

The data reveals that MSC added an impressive 14.1 million TEUs (47% growth) to its equity-adjusted totals over the five-year period from 2019-2024, while CMA CGM expanded by 4.6 million TEUs (55% growth).

The emergence of hybrid terminal operators represents the most significant structural shift in the industry.

These carrier-owned terminal operators have successfully balanced commercial operations with strategic cargo security, creating a new competitive paradigm.

Unlike pure-play terminal operators, hybrid operators can optimize vessel scheduling and terminal utilization simultaneously, creating efficiency advantages that independent operators struggle to match.

GTOs have demonstrated the strategic value of geographic diversification during 2024’s unprecedented operational challenges.

The Red Sea crisis, which affected 22% of global container trade typically transiting through the Suez Canal, highlighted vulnerabilities in concentrated terminal portfolios.

Also, operators with diverse geographic footprints could redirect traffic and maintain operational continuity, while those concentrated in affected regions faced significant volume losses.

China Merchants Port Group exemplifies this strategy, though their expansion has been primarily domestic, increasing shareholdings in Chinese port groups while making limited overseas investments since 2019. In contrast, MSC and CMA CGM have pursued truly global expansion strategies, acquiring assets across multiple continents to create resilient operational networks.

The capacity expansion phase has coincided with accelerated adoption of advanced terminal operating systems, including artificial intelligence applications and automated stacking cranes.

The projected capacity expansion reflects the culmination of investment decisions made during the immediate post-pandemic period of 2021-2022, when widespread port congestion triggered substantial terminal upgrade and expansion projects.

This creates both opportunities and challenges, as the industry must absorb this additional capacity while managing potential overcapacity scenarios.

The capacity expansion also reflects a strategic response to supply chain resilience requirements identified during recent disruptions.

Customers and supply chain managers are increasingly valuing redundancy and flexibility over pure cost optimization, driving demand for additional capacity that can serve as backup options during crisis periods.

The success of hybrid terminal operators and the challenges posed by recent disruptions suggest that future growth strategies will emphasize both geographic diversification and network integration.