Business consultants at AlixPartners have suggested the remaining members of THE Alliance should attempt to form a vessel sharing agreement with Mediterranean Shipping Co (MSC), the world’s largest containerline, as global liner groupings prepare for a major reshuffle early next year.

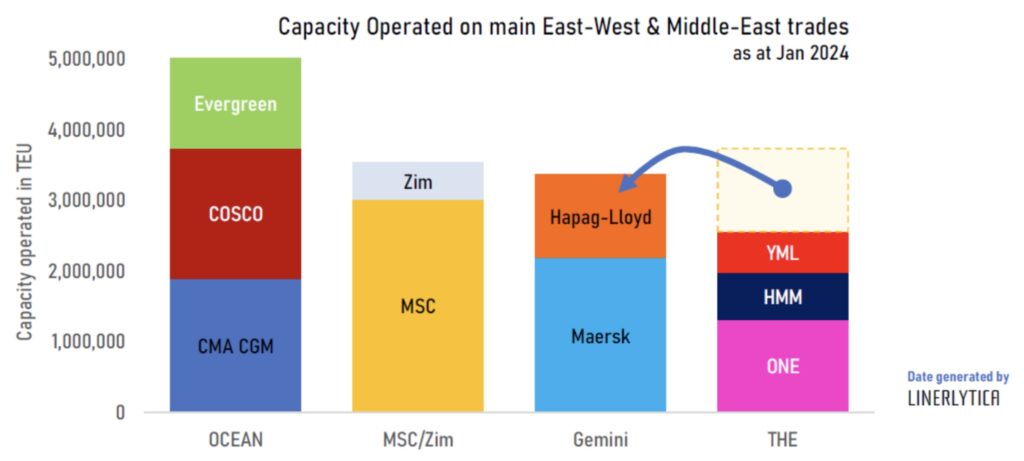

MSC is splitting with Maersk in their 2M grouping on the main east-west trades next year, with the latter recently poaching Hapag-Lloyd from THE Alliance to form the Gemini Cooperation next February, with MSC stating its intention to go it alone. Meanwhile, in a bid to quash speculation on liner departures, the members of the Ocean Alliance, the third global grouping, late last month committed to remain together through to 2032, leaving HMM, Yang Ming and Ocean Network Express (ONE) alone in THE Alliance as the smallest grouping.

“The Ocean Alliance’s somewhat surprising announcement of continued cooperation through 2032 will require a strategy shift for the remaining members of THE Alliance or a potential vessel sharing agreement between THE Alliance and MSC,” AlixPartners suggested, adding: “If MSC remains independent, this reshuffling will result in four distinct cooperatives competing for volume on the key head-haul trades, which will act as a brake on rate rises.”

Speaking at TPM, container shipping’s annual mega summit in Long Beach, this week, Rolf Habben Jansen, Hapag-Lloyd’s CEO, said the Gemini Cooperation would remain an exclusive club between his company and Maersk.

Speaking at the same event, ONE’s CEO Jeremy Nixon maintained his company would have better network solutions next year than this year.

Nixon told delegates that a number of discussions were still under way on potential new partnerships with an update due early next month.

Speculation in the market has pointed to potentially having Wan Hai join THE Alliance, but Lars Jensen, founder of container consultancy Vespucci Maritime, noted in a recent social media post that the Taiwanese liner would be “far from able to plug the gap left over from Hapag’s exit”.

For Jensen, MSC will likely continue on its own. “They have the scale to do so, and the flexibility associated with not having to compromise with partners is indeed valuable,” he said.

“The churn in the ocean carrier alliances that have become a feature of the industry will exert counterpressure on any rate increases,” AlixPartners argued in its new 10-page report into liner shipping.

MSC

MSC